MI 2599 2011-2026 free printable template

Show details

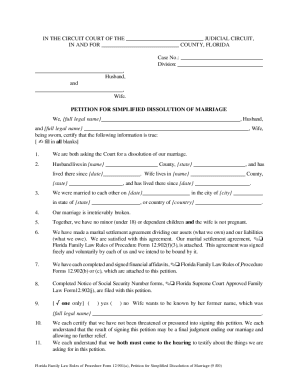

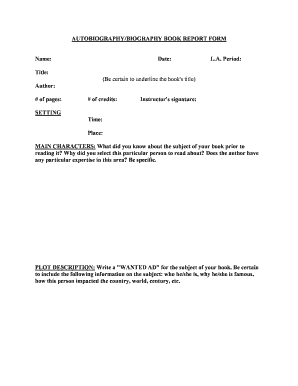

Identification In addition to the Principal Residence Exemption from local school operating taxes the legislature has passed a separate exemption for farmland. Reset Form Michigan Department of Treasury 2599 Rev. 05-11 Issued under P. A. 237 of 1994 as amended. Filing is required if you wish to receive an exemption. Claim for Farmland Qualified Agricultural Exemption from Some School Operating Taxes Do you need to file this claim If you answer YE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 2599

Edit your form 2599 michigan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan senior property tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan homestead property tax credit calculator online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI 2599. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MI 2599

How to fill out michigan form 2599?

01

Start by obtaining the Michigan form 2599. This form can be downloaded from the official Michigan government website or obtained from the appropriate department.

02

Read the instructions provided with the form carefully. The instructions will guide you through the process of filling out the form correctly.

03

Begin by providing the necessary personal information. This may include your name, address, contact information, and any other requested details.

04

Proceed to the specific sections of the form that require your input. These sections may vary depending on the purpose of the form. Make sure to fill out each section accurately and completely.

05

If there are any supporting documents or attachments required, ensure that you provide them and attach them securely to the form.

06

Double-check all the information you have entered on the form to ensure accuracy. Mistakes or incomplete information may cause delays or complications in processing your form.

07

If there are any additional steps or actions required after completing the form, such as obtaining signatures or sending copies to certain departments, make sure to follow those instructions as well.

Who needs michigan form 2599?

01

Individuals who are required by the Michigan government or other entities to provide specific information or complete certain processes may need to fill out Michigan form 2599.

02

Depending on the purpose of the form, it may be required by individuals seeking permits, licenses, certifications, government assistance, or participating in various programs or initiatives.

03

The exact individuals who need to fill out Michigan form 2599 may vary depending on the specific requirements set forth by the Michigan government or the organization requesting the form. It is essential to refer to the instructions or consult the appropriate authorities to determine if you need to fill out this particular form.

Fill

form

: Try Risk Free

People Also Ask about

How do I get property tax exemption in Michigan?

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

How much is the Michigan Homestead property tax credit?

General claimants who do not qualify for special consideration receive a homestead property tax credit equal to 60% of the amount their property taxes exceed 3.5% of their income, up to $1,200. This credit may be claimed regardless of whether or not a Michigan income tax return (form MI-1040) must be filed.

Who qualifies for farm tax exemption in Michigan?

To be eligible for the qualified agricultural property exemption, a structure must be a related building and must be located on a parcel that is classified agricultural or that is devoted primarily to agricultural use. However, the ½ acre parcel may qualify for the principal residence exemption.

Who qualifies for property tax exemption in Michigan?

Pursuant to MCL 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to postpone paying property taxes. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer.

What does Michigan Homestead property tax credit mean?

The Homestead Property Tax Credit is a refundable credit avail- able to eligible Michigan residents who pay high property taxes or rent in relation to their income.

How does the Michigan Homestead property tax credit work?

General claimants who do not qualify for special consideration receive a homestead property tax credit equal to 60% of the amount their property taxes exceed 3.5% of their income, up to $1,200. This credit may be claimed regardless of whether or not a Michigan income tax return (form MI-1040) must be filed.

Who qualifies for Michigan Homestead property tax credit?

You were a resident of Michigan for at least six months during the year. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied. If you own your home, your taxable value is $143,000 or less. Your total household resources are $63,000 or less.

What is the income limit for the Michigan Homestead property tax credit?

Your total household resources were $63,000 or less (part year residents must annualize total household resources to determine if a credit reduction applies)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the MI 2599 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MI 2599 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit MI 2599 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MI 2599.

Can I edit MI 2599 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MI 2599 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is MI 2599?

MI 2599 is a tax form used in Michigan for reporting certain information related to tax credits and exemptions.

Who is required to file MI 2599?

Taxpayers who qualify for specific tax credits or exemptions in Michigan are required to file MI 2599.

How to fill out MI 2599?

To fill out MI 2599, taxpayers must provide personal information, details regarding their tax credits or exemptions, and any other required data as specified in the form instructions.

What is the purpose of MI 2599?

The purpose of MI 2599 is to enable taxpayers to claim eligible tax credits or exemptions while ensuring proper reporting to the state tax authorities.

What information must be reported on MI 2599?

Information that must be reported on MI 2599 includes taxpayer identification details, the type of credit or exemption claimed, supporting documentation, and any relevant financial details.

Fill out your MI 2599 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 2599 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.